Get more offers with PrivSource

We help you find vetted investors who are looking to acquire lower and middle market businesses.

Selling your business has never been easier with PrivSource

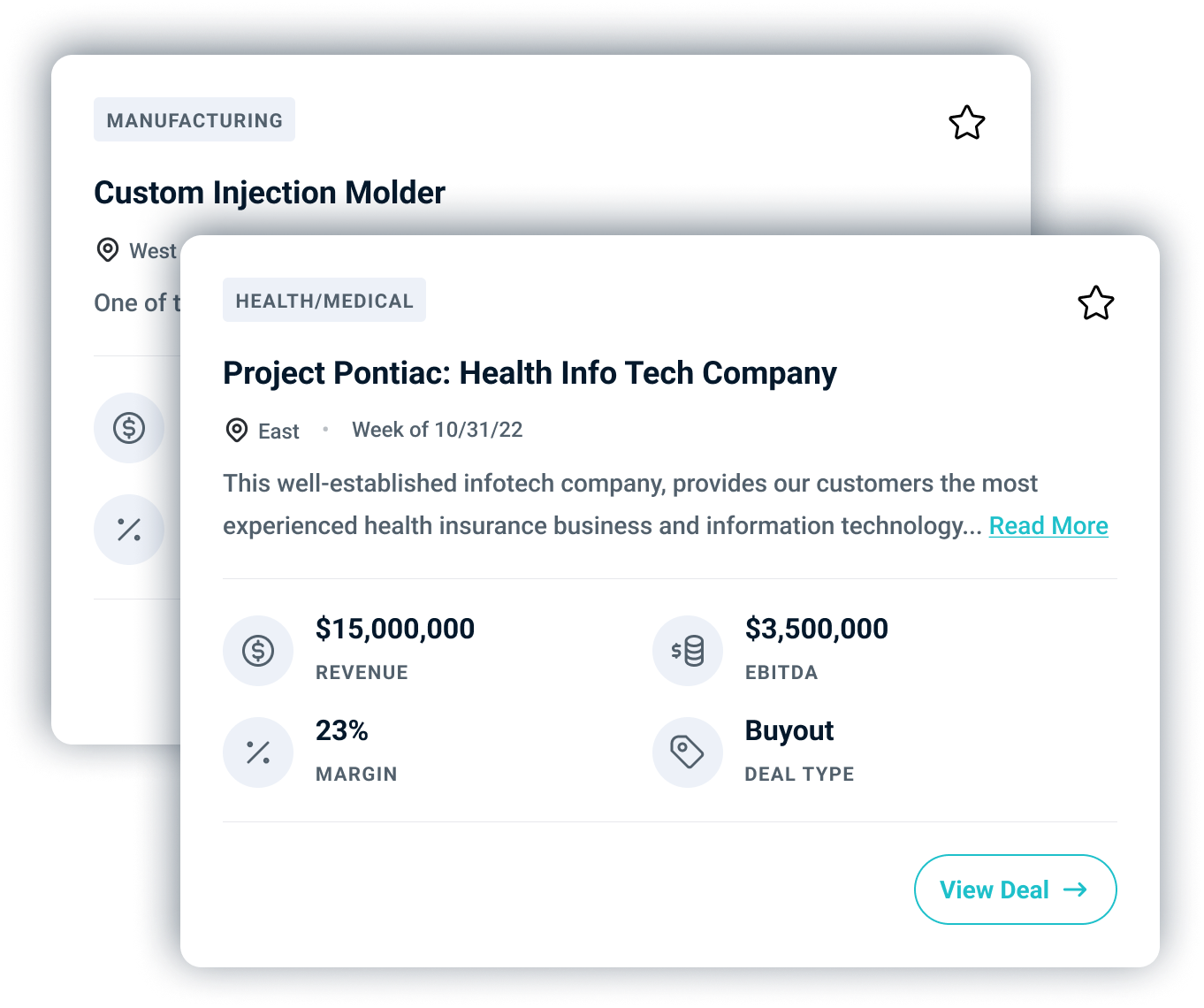

PrivSource is a private, deal sourcing network for experienced lower and middle market M&A professionals. If you are a business owner/representative looking to sell your $5m-$150m business, then you’ve come to the right place.

$500K-$25M EBITDA

Most businesses are sold as a multiple of annual EBITDA. At this end of the market, EBITDA can refer to seller's discretionary earnings or "SDE".

$5M-$150M REVENUE

Most buy-side firms on the PrivSource platform are seeking companies with revenues in the range of $5M-$150M.

$1M-$50M ARR

Not all revenues are created equally. We see the most success with software and subscription businesses with recurring revenue that do $1M-$50M in ARR.

We help you sell your business for FREE

It's your equity, keep more of it!

Traditional M&A process

-

Hire M&A advisor

-

Pay large success and retainer fees ($100k-$1m*)

-

Banker/M&A Advisor runs the sales process

-

Private and confidential process

- *source: masource.org

The PrivSource difference

- List your business confidentially through PrivSource’s private network

- Pay zero success fees and no listing fees

- Run the process on your time

- Receive customized professional help

How it works

1 Submit your application

Join the thousands of lower and middle market M&A professionals who leverage PrivSource for deal making. Since we’re a vetted network, all we need is an application to get started.

2 Submit your deal

List your deal confidentially through PrivSource and receive vetted leads from vetted buy-side firms.

3 Browse buy-side mandates

Browse the investment criteria of prospective firms and target groups who you think may be a good fit.

4 Run your own M&A process

You control the timeline. You decide which buy-side firms to engage with when selling your company. You pay zero fees and commissions.

5 Hire help as needed

Leverage PrivSource’s network to hire professional advisory help if and as needed.

Private M&A platform for experienced professionals

PrivSource provides a way for business owners and sell-side advisors to get in front of buyers who they may miss through a traditional M&A process.

-

Family Offices

Private group with assets in excess of $50 million

-

Private Equity Groups

Investing out of a dedicated fund

-

Traditional Search Funds

Search funds that have raised capital from a group of investors

-

Corporate M&A

Strategic buyers seeking horizontal or vertical expansion through acquisition

-

M&A Advisory Firms

M&A professionals providing buy-side and/or sell-side services on behalf of private equity groups or business owners

-

Sell-side Intermediaries

Typically boutique investment bankers or high quality brokers providing M&A services to lower mid market companies

Nationwide US & Canada Based

Our sweet spot is $500k-$20mm in EBITDA. We generally require engagements to have north of either $5mm in revenue OR $500k in EBITDA. We understand not all good deals fit inside a box so we occasionally make exceptions if the deal falls under our EBITDA/ revenue threshold, but exhibits high-quality characteristics.

Quality

All buyers, intermediaries, and deals are fully-vetted. Translating into time and resources saved.

Trust

Our private platform engages only buyside members with high certainty of closure

No Fees

No commissions, referral, or success fees. Ever

Anonymous

Share only key metrics through discreet and anonymous listings

Closed and secure

Thousands of firms and intermediaries across the lower middle market M&A ecosystem use PrivSource to source and list buyout opportunities.

PrivSource was a game changer. Of all the sourcing tools we tried, PrivSource had the best deals, the widest range of intermediaries, and the most reasonable fee structure (no acquisition fee).

Chris Sykes

Managing Director, Eagle Rock Capital

Trying to find good deals is difficult. PrivSource takes all the great deals available and consolidated them into one place and makes it easy to search for specific criteria. It makes sourcing deals extremely easy and cost-effective.

Todd Burdon

Executive Director, Rhyno Equity Group

Anyone sourcing via intermediaries or non-proprietary outreach will benefit from the amount of time the platform saves you during the week. The sell-side reps I’ve dealt with (bankers/brokers/advisors) have all produced quality materials and there hasn’t been one instance ‘haggling’ for basic data.

Matthew Hogan

Managing Partner, Needham Heights Holdings

FAQs

What is PrivSource?

Deal Network is a private, curated marketplace of active buyout opportunities. All sell-side listings are vetted for quality, and all buy-side members are screened for acquisition experience and capital certainty, so sellers connect only with serious, credible buyers.

AI Researcher is an M&A-trained AI agent that instantly builds strategic buyer lists tailored to your deal. It is trained on real transactions and understands what makes a buyer a true fit, going far beyond basic keyword matching or static databases.

Our members include private equity firms, family offices, investment bankers, independent sponsors, strategic acquirers, and experienced M&A advisors. We're industry agnostic and currently support coverage across the U.S. and Canada. All members must apply and be approved before gaining access.

How does PrivSource source opportunities?

Deal Network also aggregates select opportunities from public marketplaces and partner firms, giving buyers additional exposure to curated listings without needing to search across multiple sources.

AI Researcher supports sell-side professionals by identifying strategic buyers tailored to each specific deal, using AI trained on real M&A transactions to go beyond basic keyword matching and surface true fit.

This combination of member-submitted deals and intelligent buyer discovery creates a more targeted, high-quality experience than traditional listing platforms.

Is PrivSource like Axial or BizBuySell?

We don't charge success fees and we don't act as hands-on matchmakers. Instead, we provide a high-quality, self-directed platform where vetted buyers and sellers can connect directly.

Every member is screened before gaining access, ensuring a more credible and efficient marketplace.

Compared to BizBuySell, our deals are typically more substantial and professionally represented, coming from vetted advisors. Compared to Axial, we offer greater flexibility and intelligence. AI Researcher is the first AI agent built specifically for M&A — helping advisors instantly generate targeted buyer lists by analyzing real transaction patterns across the broader M&A ecosystem, not just within a private network.

Is PrivSource right for me/my firm?

Buy-side users include private equity firms, family offices, independent sponsors, strategic acquirers, and search funds.

Sell-side users include investment bankers, M&A advisors, and quality business brokers.

Whether you're sourcing deals or buyers, we help you move faster and discover better-fit opportunities.