Get a Buyer List You'd Be Proud to Share with Your Client

It's not just a list. It's the right buyers for your deal.

Sycamore Partners invests in the Real Estate & Construction sector.

Early-stage backing for frontier hardware; aligns with your automation profile.

Looking to vertically integrate eco-friendly building materials.

Strong track record in natural & organic CPG—aligns with plant-based strategy.

Investing in advanced-manufacturing tech to modernize operations.

ESG-first thesis aligns with renewable-energy services.

Finding buyers matching your criteria...

Start with 3 free lists.

No credit card required.

Join 5,000+ deal professionals who trust our platform

You Don't Need a Database You Need an AI Researcher

Databases overwhelm you with noise. AI Researcher cuts through it, delivering buyers who are both credible to show your client and strategically capable of acquiring the company.

Built on Real M&A Intelligence

Trained on thousands of transactions, AI Researcher learns from how deals actually close, not just surface-level industry codes.

Strategic Fit, Not Just Keywords

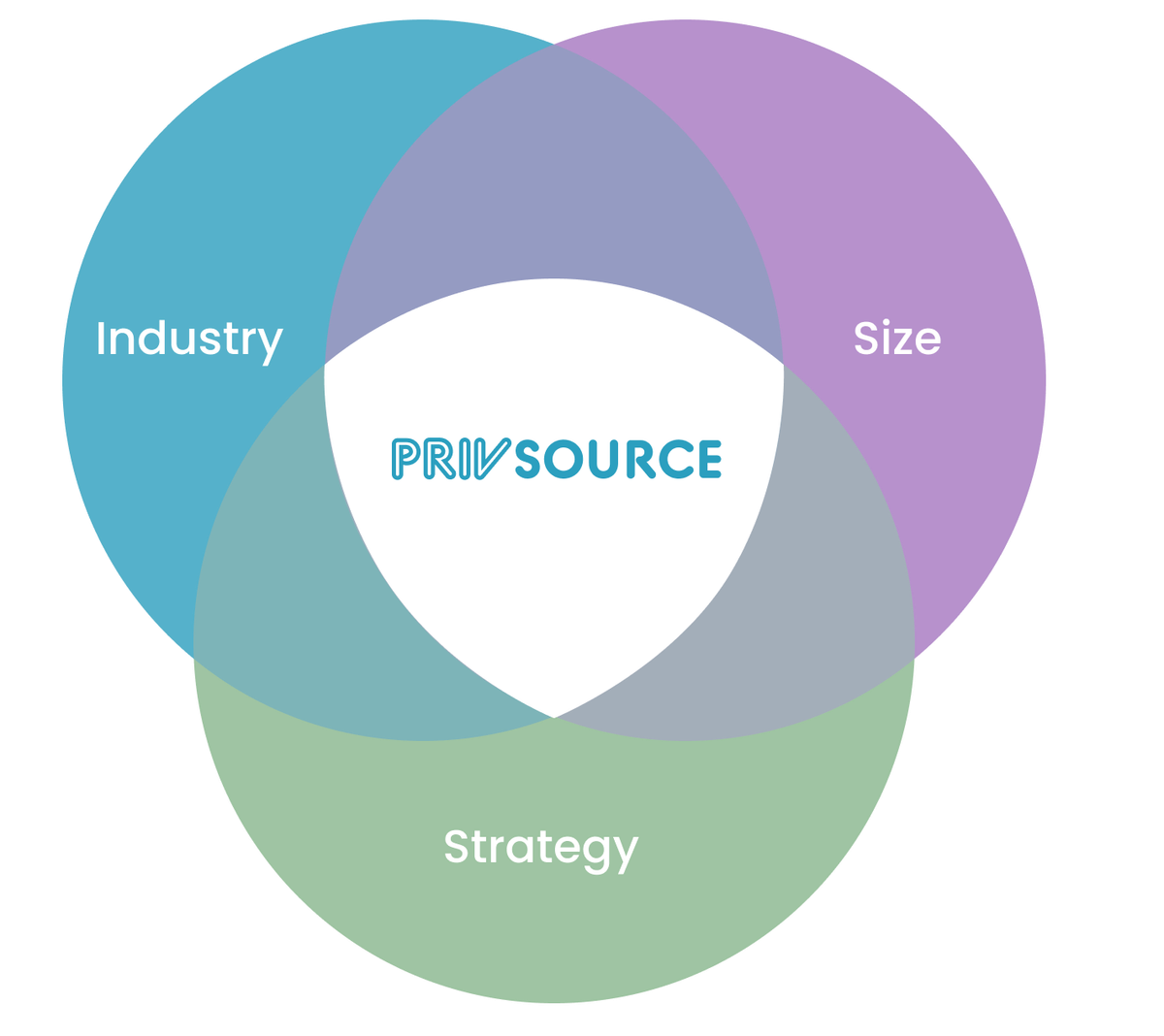

Our AI goes beyond blunt filters to uncover buyers who match on size, sector, and strategy—the firms most likely to transact.

Lists You Can Put in Front of Clients

You’ll have a buyer list that feels airtight: credible, complete, and ready to share with confidence.

Project Horizon – Specialty Industrial Services

You describe the deal. AI Researcher finds the buyers.

Create a buyer list for our company. We manufacture engineered building products, like glulam, laminated veneer lumber, and other structural wood components.

Here's what I've gathered about the company's customer focus:

- Core Customers: Construction firms and developers involved in commercial and residential projects.

- Markets Served: North America, particularly regions with high growth in construction.

- Unique Attributes: Innovative use of sustainable materials, reputation for high-quality products, and ability to customize solutions for specific projects.

I'll generate a buyer list for you now.

Analyzing your company profile and identifying potential buyers...

Enter a few key details such as industry, size, business model, and anything else that matters. 2

AI Researcher uses real M&A patterns and investment criteria to identify buyers that actually make sense, even if they haven't done a deal just like this before. 3

Get a ranked list of strategic and financial buyers with decision-maker contact info, ready to share or act on.

Why deal professionals trust AI Researcher

Trained on thousands of real M&A transactions

Understands nuance — not just NAICS codes or keywords

Prioritizes strategic fit based on deal logic and investment criteria

Includes decision-maker contact info you can actually use

Trusted by investment banks, brokers, and M&A advisors across North America

"The tool cuts down significant research time and reduces our need for multiple paid accounts. We're finding buyers who've actually done deals in our sectors that we would have missed with traditional database searches."

"AI Researcher doesn’t just extend our reach, it delivers a completely different layer of strategic buyers we weren’t finding elsewhere."

Built for Every Stage of the Process

Pitch Prep

Instantly generate a buyer list to support your proposal and win the mandate

Go-to-Market

Launch faster with qualified buyers already prioritized and ready for outreach

Client Engagement

Share a thoughtful, data-backed list that builds confidence and shows strategic reach

Coverage Check

Make sure you're not missing key buyers before going to market

Adjacency expansion

Uncover strategic and financial buyers you wouldn’t find with traditional filters

Simple, flexible pricing for serious dealmakers

Start with 3 free buyer lists — no credit card required.

Check Upgrade only when you're ready for more volume, contacts, or research.

Plans are built to scale with your workflow.